Crystal ball gazing with the National Grid

Earlier this month, the Verco team discussed the National Grid’s latest Future Energy Scenarios (FES) report[1]. Published annually, the report presents a range of potential energy futures for the UK, predicting how energy will be supplied and used out to 2050. This short piece presents some of our thoughts.

The 2017 Future Energy Scenarios report

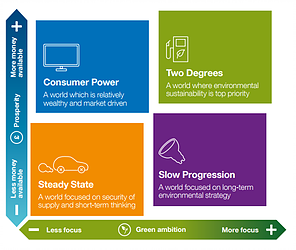

The 2017 FES report presents four potential scenarios for the UK’s energy future. These vary according to two variables: the level of green ambition throughout society, and the economic prosperity of consumers, governments and businesses. The scenarios are set out in the figure below. Underlying the scenarios are four key drivers of change in the UK energy system, summarised in a recent report by Forum for the Future[2] as the ‘4 D’s’: decentralisation (more distributed power generation), digitisation (greater levels of data connectivity and algorithms to manage energy), democratisation (wider ownership and management of energy assets) and decarbonisation (greener sources of electricity and gas).

Verco’s thoughts

A number of findings from the report stood out. All four scenarios predict a decrease in total demand for gas and electricity by between 15% and 30% compared to today. However, the potential electrification of heat, increased uptake of electric vehicles and growing, more middle-class population (who own more electrical appliances) mean that managing the peak demand for electricity will be a greater challenge with peak demand increasing by a corresponding 15% to 30%.

This becomes more complex when you consider the charted increase in distributed renewable generation, with 33GW of solar panels predicted to be operational in the UK by 2030. If households are able to generate power to cover their needs, this will lead to falling demand and also falling voltage. This latter reduction will significantly change the daily profile of voltage regulation required by the National Grid. Greater flexibility in the system, ideally through access to additional storage, will be necessary.

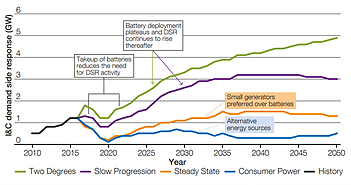

We noted the National Grid’s expectation, in all scenarios, that industrial and commercial demand side response activities are expected to decline substantially over the next 5-10 years. DSR and battery products compete for the same market, enabling the Grid to manage at times of peak demand. With falling unit costs for storage, batteries are expected to step up.

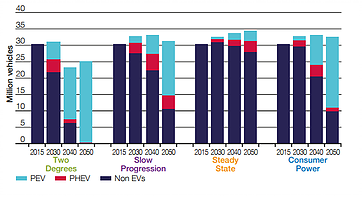

Interestingly the ‘Two Degrees’ and ‘Consumer Power’ scenarios both predict significant uptake of EV’s, but for different reasons. In the former, consumers are more environmentally conscious whilst in the latter the switch is driven by the desire for the latest products.

The absence of new economic models is notable. Economists are increasingly observing the market failures of our current economic system, which places stress on environmental and social resources, This has led to new models such as the circular economy and ‘Doughnut Economics’ – in which planetary and social boundaries are protected to create a “safe space for humanity to thrive in”.

Finally, the report touches on megatrends such as the rise of shared autonomous transport, the increased use of automation by businesses, and an ever more decentralised energy system. At a recent Crowd event Sean Culey, a leading thinker and speaker on disruptive technologies, presented the current predictions. At a time of such opportunity for massive change for the built environment and working practices, how should the National Grid decide on where to invest and how?