SBTi Corporate Net Zero Standard V2 Consultation: what are the key proposed changes?

SBTi is now consulting on an updated Net Zero standard seeking to reconcile the need for more ambitious action to reach the 1.5 degree goal while ensuring targets are accessible to all companies globally.

Responses to the proposed changes can be put to SBTi until 1st June 2025. The new standard would be in force from 2027, and SBTi has committed to releasing a transition process to smooth its adoption. We outline the main updates and the questions this poses below.

Background

The consultation published 18th March 2025 marks the first major update to the SBTi’s Corporate Net Zero Standard since its launch. The original 2021 Standard provided a much needed definition of corporate net zero, building on the original SBTi framework first established in 2015 to guide ‘non-state actors’ in setting GHG reduction targets aligned with the Paris Agreement. Since then, more than 1,600 businesses globally have had their net zero targets validated to the Standard, and a further 1,500 have committed to do so.

What’s happening?

The consultation contains a large number of proposals. Key features are: moving beyond simply target setting towards a continuous improvement cycle approach, tightening up aspects of Scope 1 and 2 target setting, introducing greater flexibility to meeting Scope 3 targets and focusing attention on emission intensive activities. There is only a limited role for offsets.

An initial process to update the Corporate Net Zero Standard in 2024 stalled following controversy over the possible role of carbon offsets to meet Scope 3 targets, leading to the departure of the then CEO. This consultation marks a restart of that process. The overarching aim is to “support more companies to set targets and to make corporate climate action more effective”. The public consultation runs to 1st June 2025, followed by pilot testing and second consultation in H2 2025. The final revised Standard is expected to be released in 2026.

What does it mean for organisations that already have SBTi validated targets?

Organisations that already have validated targets do not need to do anything until their near-term target expires or by the end of 2030, whichever is earlier. After that, companies would be expected to set near-term targets for the subsequent 5 year period using Version 2 by the end of 2030.

What does it mean for organisations that are about to seek target validation?

For 2025 and 2026, companies can still set targets for 2030 using the existing Corporate Net Zero (V1.2) and Near-Term Criteria (V5.2) methodologies. These targets will be valid for either five years or until the end of 2030, whichever is earlier. There is also mention of the SBTi providing a “pathway” for companies with targets validated in 2025 and 2026 to align their Scope 3 targets with Version 2. From 2027, SBTi expects all companies to set targets referring to Version 2 only.

Key changes

The SBTi is walking a tricky line. It is attempting to make the Standard accessible to as many as possible to maximise its adoption and hence impact, whilst also aligning with the hard numbers of the 1.5 degree global carbon budget, which is baked into the initiative’s very purpose of being ‘science-based’.

The proposed changes therefore include a mixture of proposals that respond to one or other of these often-conflicting objectives. The 10(!) page Executive Summary of the consultation document provides a decent general summary of the changes, including a comparison table against version 1. We won’t duplicate it in full here, but the key proposals that caught the Verco team’s eyes grouped by theme are:

Making the standard more accessible

- Differentiated requirements based on company size and geographic location. Two categories are introduced. Category A companies (large and medium-sized companies operating in higher-income geographies) are required to follow all criteria. Category B companies (Medium-sized companies operating in lower-income geographies and SMEs everywhere) are offered increased flexibility by making some criteria optional, e.g. only near-term targets required and 24 months to develop a target, not 12 months.

- Greater Scope 3 target-setting optionality. There are three categories of target: absolute targets, intensity targets and supplier alignment targets. A combination of these targets can be used to cover the minimum scope target boundary. So, a company may have various intensity targets for the purchase of emission-intensive commodities, a supplier engagement target for its logistics partners and an absolute reduction target for the remaining scope 3 emissions.

- Greater Scope 3 delivery flexibility. This is one of the most significant proposals in the consultation. The final form will impact on both the ease of achieving scope 3 reductions and how to report them. Details are lacking on the exact proposals, but the consultation includes the concept of GHG reporting using ‘activity pool’ emission factors where direct traceability is not possible. It also introduces the concept of Indirect Mitigation as a time-limited measure (duration to-be-confirmed). Similar to market-based Scope 2, this could include ‘book and claim’ systems for lower carbon fuels to address transport emissions. This measure would not currently affect a company's emissions under the GHG Protocol Standards, but would count toward scope 3 target achievement. There is no mention yet on how the integrity of such options would be assured e.g. food vs. fuel considerations, fraud, etc.

Aligning with latest science and best practice

Separate targets for each scope. Separating the targets removes the possibility of using easy-to-achieve market-based scope 2 reductions to effectively reduce the ambition level for scope 1 reductions. For example, under the current standard, if electricity makes up a significant proportion of a Scope 1 and 2 footprint, purchasing Renewable Electricity Certificates (RECs) alone can meet the majority or all of the Scope 1 and 2 reduction target, effectively allowing direct fossil fuel emissions to continue unchecked.

Scope 1 and 2 targets: Category A companies must set near-term AND long-term (net zero) targets. Compulsory long-term targets for Scope 3 is a consultation question. Verco’s view is that long-term Scope 3 targets are important for highlighting the step changes and major investments required to reach net zero. Focusing solely on short-term targets could lead to incremental gains only, forestalling deep decarbonisation options.

End to market-based only Scope 2 targets. Requirement to set both a location-based target which reflects actual grid emissions, as well as either a market-based or a zero-electricity-based target. This closes the loop hole of purchasing renewable energy certificates (REC’s), and similar products, to claim lower emissions without actually lowering real grid emissions. The Standard also includes recommendations on choosing renewable electricity procurement options with higher environmental integrity, e.g. within the same electricity grid.

Removal of temperature pathway optionality in scope 3 targets. There is now only one (1.5 degree) ambition level, albeit differing target options as mentioned above which will have slightly different ambition outcomes depending on the context.

All Tier 1 suppliers to align with net zero by 2050: new requirement based on the share of total procurement spend on Tier 1 suppliers that are aligning to 1.5degC pathways (100% by 2050 and linearly pro-rated beforehand). ‘Net zero alignment’ is defined as Transitioning (e.g. have SBTs, not necessarily validated) or have already achieved net zero.

Emission-intensive Tier 1 suppliers to align with net zero by 2030: as above, but by 2030. In practical terms this will often mean buying energy-intensive goods and services that fall beneath certain emission intensity thresholds, as defined by SBTi’s sector guidance.

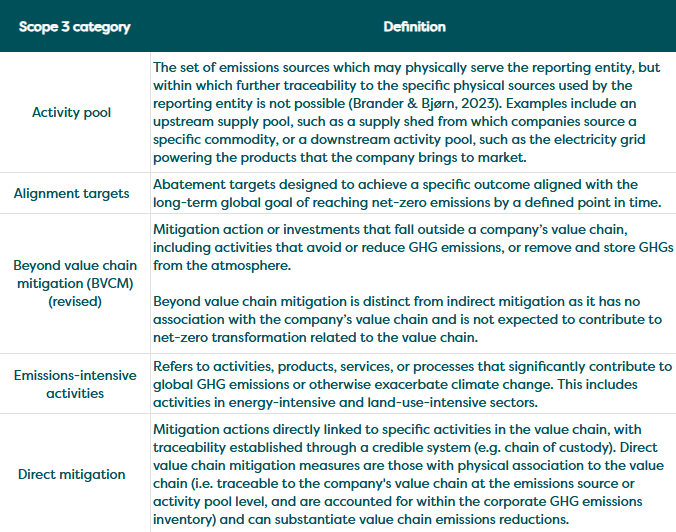

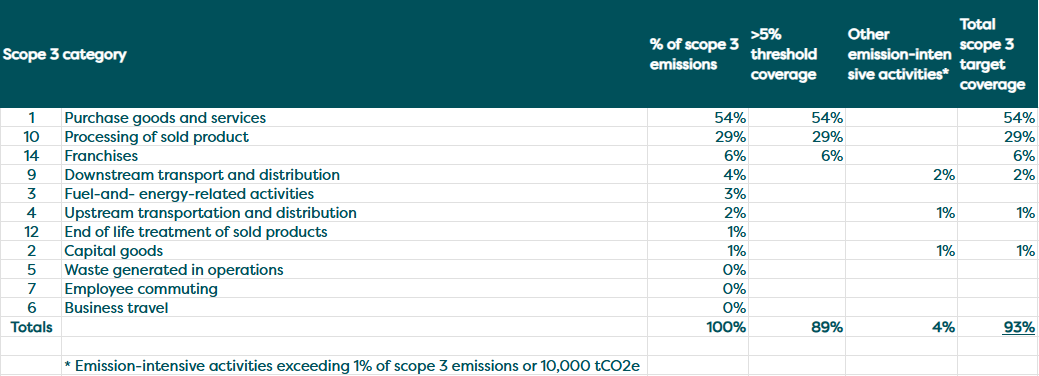

- Scope 3 target boundary based on relevance of emissions rather than the fixed 67% and 90% minimum coverage of the current Standard. Two thresholds for inclusion in the Scope 3 target boundary are proposed. First, any Scope 3 categories contributing over 5% of scope 3 emissions. Second, emission-intensive activities exceeding 1% of scope 3 emissions or 10,000 tCO2e/yr. Emission-intensive activities are defined as those listed in Tables D.4 and D.5 of the consultation document. The list cross-references SBTi’s sector guidance and includes various agricultural and industrial commodities, aviation, ICE road transport, shipping, commercial buildings and energy. Table 1 below shows a worked example to illustrate.

Table 1: Example Scope 3 target boundary determination (93% target coverage)

A deficiency with this approach alone is that there does not appear to be a way to exclude immaterial emission sources from within each category. For example, in purchased goods as services, it would save reporting and effort to exclude the long tail of indirect spend and SME suppliers which are never going to be a focus for supplier engagement.

Introducing a continuous improvement cycle

5 year cycle: End-to-end framework, with interim targets in 5 year blocks. Target renewal validation triggered at end of 5 year review cycle or if >5% change in base year emissions, e.g. through structural changes or GHG inventory methodology updates.

Assurance: Requirement for Category A companies to obtain third-party limited assurance on their base year for the full value chain emissions. For companies with base years some way in the past, or complex supply chains, this could be a difficult undertaking.

Climate Transition Plans:The consultation includes a proposal to either require or recommend to publicly report a Climate Transition Plan (CTP) within 12 months of setting target. CTPs are being integrated into policy in around 30 jurisdictions worldwide (including the UK) and are encouraged in disclosure frameworks such as IFRS and CDP. This requirement would further support the development and disclosure of CTPs.

The role of offsets and Beyond Value Chain Mitigation (BVCM)

Modest role for carbon credits. The SBTi have not continued with the proposals in last years’ position / research papers to broaden the role of offsets to meet reduction targets. The proposals in the consultation relate to residual emissions, while seeking to provide recognition to companies that support Beyond Value Chain Mitigation (BVCM). BVCM remains an additional and voluntary activity, rather than a contributing to targets achievement.

Optional additional recognition for “ongoing emissions”. This aspect is a nod toward the ‘carbon neutrality’ pledges of old, before the phrase got effectively band as greenwashing, thereby greatly reducing climate finance flows to BVCM. Companies are encouraged and would obtain some kind of recognition for transparently reporting activities to take responsibility for ongoing emissions e.g. high-integrity carbon credit purchases, direct financing of mitigation projects, conservation efforts. Again it would not count toward target achievement.

Consultation on 3 alternative options to address residual emissions. These are:

Companies being required to set both near- and long- term removal targets.

Companies being recognised for setting removal targets.

Residual emissions addressed through additional abatement or removals.

Options 1 and 2 look designed to help stimulate the approaches and markets for removals by creating demand prior to achieving net zero. Option 3 is the same as under version 1 of the Standard – leaving it to the end. There are additional consultation questions around the criteria for the durability of eligible carbon removal options.

Concluding thoughts

Overall, the proposed revisions look broadly in-line with the SBTi’s stated objectives of supporting more companies to set targets and to make corporate climate action more effective. On balance, it leans more towards the latter objective, with the scope 2 loop holes being closed, greater focus on emission intensive activities and Tier 1 suppliers, and no offsetting to meet reduction targets.

Some of the proposals lack detail (e.g. how scope 3 book and claim approaches will work). Users of the Standard will need to wait until 2026 until the final form is known. In previous SBTi guidance development processes, there has been little difference between the consultation version and the final versions. In this case, given the number of open questions, we might expect a greater difference between this first consultation draft and the final version.

The Verco team will continue to track the evolution of the Net Zero Corporate Standard. For support in understanding corporate targets and climate strategy more generally please contact Tim Crozier-Cole, Head of Aim for Zero Corporates. For Real Estate related insight, please contact Ben Ross, Head of Aim for Zero Real Estate.

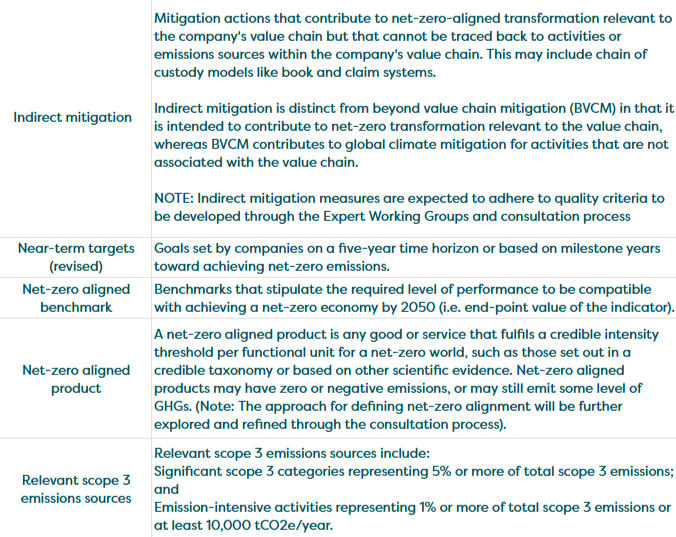

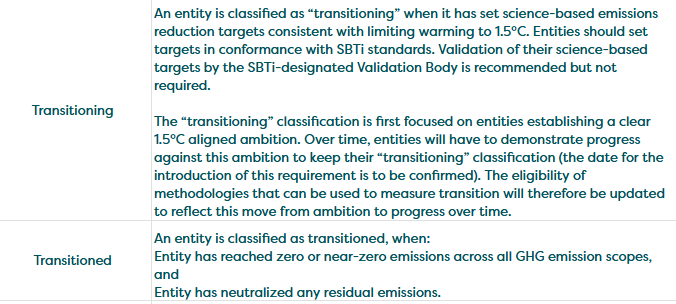

Appendix 1: Glossary of new SBTi terms

A full list of relevant terms, definitions and acronyms can be found in theSBTiGlossary. Those listed below are our selection of the most notable new or revised terms included in the consultation.