Summary of the Environmental Finance panel session hosted by Verco

Verco hosted a panel session with Environmental Finance, covering how companies are now moving beyond net zero target setting into implementation. This article summarises their expert views on the biggest drivers to action, how funds can be future focused, and what our panellists have learned from their net zero journeys so far.

Delivering the net zero transition in real estate

Navigating the path to net zero is complex and differs across companies, sectors, and financial vehicles. Tailored strategies must be put in place, especially when it comes to achieving sustainable finance. However, there are a series of common themes that run across all property investments. Fundamentally, it’s wise to build a plan that maximises your technical and commercial opportunities, then make sure you stay aware and responsive in case the situation changes.

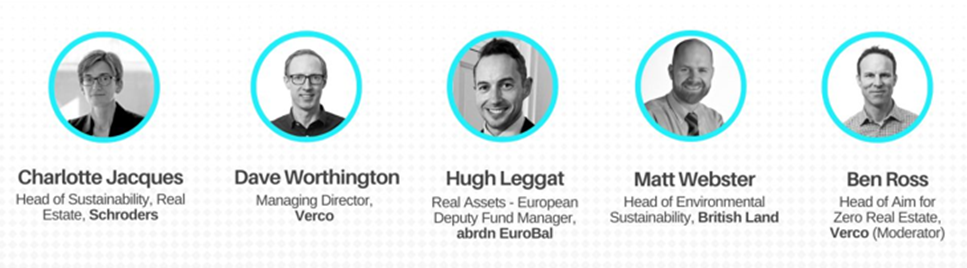

The panel

The discussion

It’s been a year of change, but the real estate sector is optimistic

It has been a year of political and regulatory change. In general, the real estate sector is cautiously optimistic as interest rates and inflation have been coming down.

This autumn has seen both the SBTI and the UK NZCBS launch new frameworks for real estate, which have provided us with increasing clarity and visibility about what we need to be doing in response to the challenge of climate change. This is especially useful now that we’re getting closer to 2030 and those who have set long-term net zero carbon goals need to demonstrate progress to their investors and stakeholders.

It is the current international process that all signatories to the UNF Convention on Climate Change have to update their nationally determined commitments by the end of February 2025. Doing so will set the trajectory for those countries for the next 10 years. Undoubtedly, to achieve these goals they will need to massively reduce emissions from real estate, which will require deployment of private capital. The UK and Brazil, who are hosting next year’s COP, have already published theirs. The UK is making a commitment to an 81% reduction by 2035 (against a 1990 baseline) and Brazil is setting an ambitious 67% reduction. We’ll see much more of this in the new year.

However, we’re also seeing significant pushback on ESG and the need to act on climate change, as the transition increases costs in some areas and restricts activities in others. There are also unintended consequences of new regulations and with significant fines being levied for greenwashing, the risk of ‘green hushing’ is increasing.

What are the biggest drivers to action?

Our panellists suggested the following as key drivers encouraging net zero action:

The performance/value of assets and attracting engagement. Investors are likely to start to build the costs required to achieve net zero into the value of assets, impacting the price they are willing to pay. So having an asset with strong ESG credentials and a NAC pathway drives capital value through confidence in future investments.

Increasing regulation and reporting requirements in real estate. While not all mandated disclosure requirements and planning regimes are becoming tighter on operational performance and embodied carbon, looking ahead and having a strong ESG perspective will enable compliance, while development and refurbishment design will unlock value and be crucial for obtaining planning permission in the first place.

Good rent incentives. For those with strong ESG credentials, there is a bit of a premium, improved letting velocity and higher rental values. However, asset managers need to prove to investors that committing money to decarbonisation will not compromise returns.

Buying/occupier trends and perspectives. New build space coming to market is signalling that occupiers are asking for, or wanting to choose, space that has the highest performance rating and the best availability and accessibility of environmental performance data.

An appreciation for the urgency of the climate emergency and the impact on the planet. Taking a long-term perspective builds trust and confidence across stakeholders.

What’s something you wish you knew a few years ago?

Looking back on their net zero journeys so far, here’s what our panellists have learned:

A really good data set and regular audits help to take a net zero project forward and show the impact interventions can make.

It’s not necessarily a level playing field in terms of understanding, especially for funds. You must think about the future but also make cases to fund managers now. Be ready and prepared. Do your audits, know your portfolio, have a clear understanding of what you think costs are going to be. And act now if there are opportunities.

Every building is slightly different, which presents a challenge when it comes to streamlining everything, but there’s still a lot that can be done to improve the process side of things. The technical challenges might be easy to overcome, but the organisational and market ones are bigger barriers. Even so, we can’t wait for the perfect framework – we have to get going now and learn lessons quickly.

We need everybody in all roles throughout the real estate value chain to contribute, so everybody needs to be upskilled. Everybody needs to know what their role is within the net zero journey and why it’s so important. It’s all about optimising what your organisation and value chain do on a day-to-day basis and engaging with a lot of people, working towards collective action.

Using pilots to prove concepts is really powerful – that is, using a bit of seed money to trial something and then scaling it up if it’s viable.

Key takeaways from the session

Don’t delay making a plan. Yes, it’s complex and takes time, but you will learn through both the planning process and the delivery. Advance preparation is crucial.

Take every commercial and technical opportunity and intervention point to reduce energy demand and carbon emissions

Funds will be forced to be more forward thinking as requirements for net zero alignment become more prevalent. Therefore, making sure you’re building Net Zero CapEx into all valuations and conducting a net zero audit as standard practice on due diligence can only help your case.

Continued demand from tenants for ESG credentials – as well as the evidence that ESG credentials drive growth and value – are key drivers for action. BREEAM Very Good or Excellent may end up being a minimum requirement, so planning for this in advance is essential.