Part 1 of 2: The Partnership for Carbon Accounting Financials (PCAF) operational carbon emission datasets

PCAF has released two significant datasets for free and open access. The first focusses on operational carbon and the second on embodied carbon. In this series of articles, we take a look at the datasets and their application.

In part 1 we review the updated European Building Emission Factor Database (EBEFD), which focusses on operational carbon emission factors for mortgages and commercial real estate. In part 2 we take a look at the data set which relates to embodied carbon emissions for real estate.

Secondary databases provide useful insights for screening and scoping processes but rely on assumptions, models and old data.

Secondary databases, such as these, offer valuable data on greenhouse gas (GHG) emissions when primary data is unavailable or unreliable. These datasets provide insights from various countries, regions, sectors, or activities over time.

However, they also have limitations. They may not reflect the most recent or accurate data on GHG emissions due to reliance on assumptions or models or simply old primary data, nor capture the full scope or account for the uncertainty or variability of the initial primary data.

Secondary databases can, however, be used for screening and scoping processes that identify and prioritise emission sources and define the boundaries for measurement and reporting. They offer a general overview of trends and drivers in a relevant sector or region, help benchmark, and compare the performance of different assets.

What the European Building Emission Factor Database (EBEFD) covers

This database covers the European Union, Norway, Switzerland, the UK, Serbia, Bosnia and Herzegovina, Kosovo, and Turkey. It provides financial institutions (FIs) with a secondary database that helps to estimate emissions based on criteria such as asset types, location, building types (residential and non-residential), and Energy Performance Certificate (EPC) ratings.

This database comprises 62,400 data points, including key attributes like energy intensities, carbon intensity (per floor area and per MWh), absolute energy, and carbon emission for an average building per asset type.

Reliability of operational carbon data sources can be assessed with the quality rating

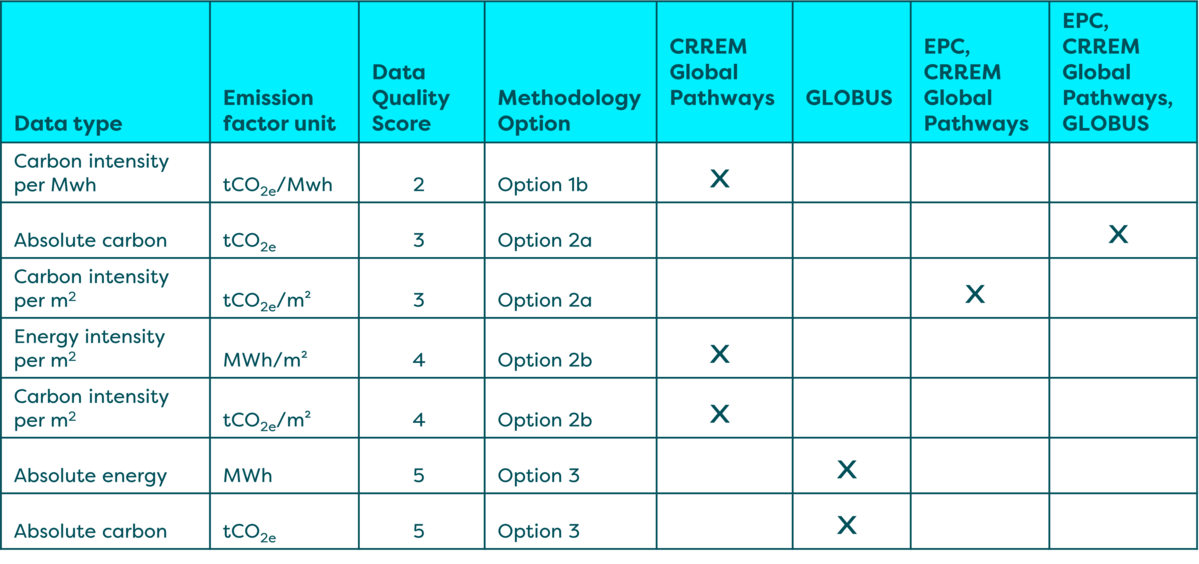

The PCAF’s EBEFD primarily relies on the Carbon Risk Real Estate Monitor Initiative (CRREM) Global Pathways for energy and carbon intensity data, focusing on operational emissions during building use. EBEFD also uses the Guidehouse GLOBUS model[1] to provide an estimated total floor area, absolute energy use and carbon emissions of various building types across different countries, which are useful when actual floor areas, energy use and emissions data are missing.

Changes in data sources and calculation methodology between the initial release in 2022 and the recent 2023 version include updates to the baseline year, methodological adjustments to align with CRREM V2, and alignment with energy labels’ final energy representation. The dataset also extends its coverage to provide CRREM factors V2 from 2020 up to 2023.

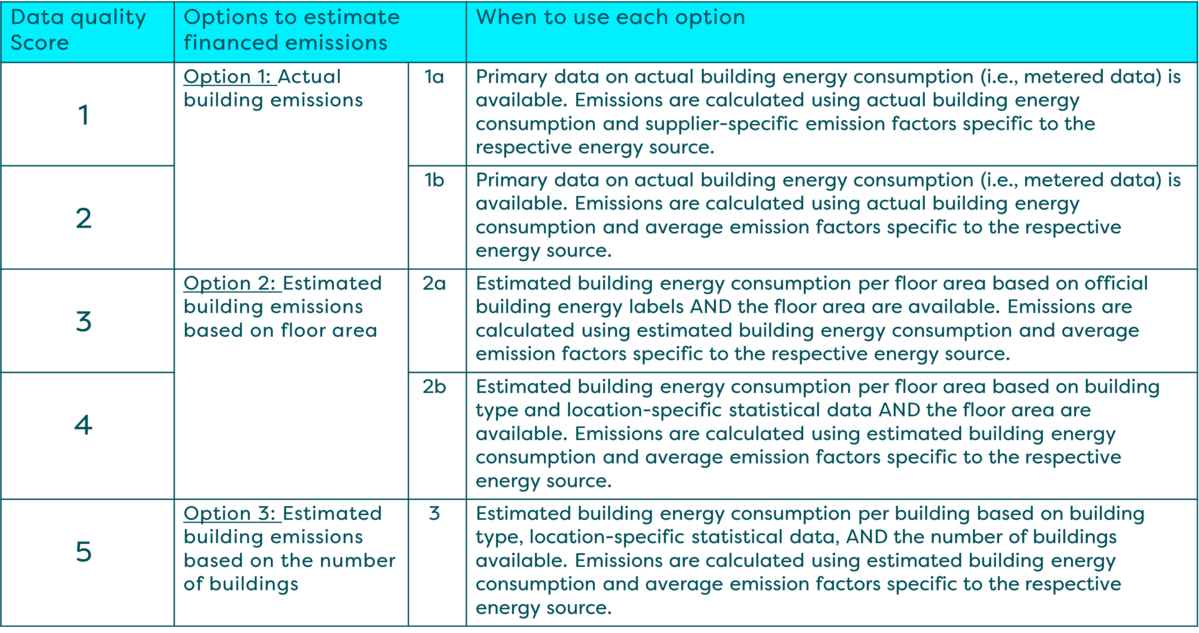

PCAF also offers data quality scores ranging from 1 to 5 to assess the data quality. See Table 1 for a detailed breakdown of the scores.

We grouped the carbon and energy data for the UK according to their data quality scores to identify which data sources are more credible than others. Table 2 below compares the data quality scores for each data source. The lower the score, the better the quality. The best score is 2 (Option 1b) for carbon intensity per Mwh from CRREM. The worst score is 5 (Option 3) for absolute carbon and energy from GLOBUS because GLOBUS provides estimated building size, total energy use and carbon emissions.

PCAF provides guidance on aligning financial institutions’ own building type categorisations with the database’s categories. However, it’s best to use actual data from buildings whenever possible, build accurate models where partial data exists and only resort to this database when there is significant missing data. It is also essential to pay attention to the data quality scores and which data source is being used, as this could have a material impact on the outcome, and therefore confidence in how it can support decision making.

Addressing material gaps in data, the EBEFD employs a strategic approach. It relies on sources like CRREM and the GLOBUS model to estimate crucial parameters when primary data is unavailable. The inclusion of data quality scores enhances the reliability assessment, guiding users in determining the credibility of different data sources. While encouraging action, it emphasises the importance of using actual building data when possible, thus promoting responsible and informed decision-making by financial entities.

The datasets will improve transparency and understanding of carbon emissions but their limitations should be appreciated, primary data should be used where possible

Applying these datasets by FIs promises improved transparency and understanding of carbon emissions in the built environment. FIs leveraging the EBEFD can make more informed decisions, gaining insights into the environmental impact of diverse building activities with very limited input data. The outcomes include enhanced strategies for reducing carbon footprints and identifying areas for improvement. However, it underscores the need for a critical perspective due to inherent limitations, emphasising the ongoing requirement for more accurate, primary data to continually enhance the reliability and precision of carbon emission assessments.

If you are interested in exploring this topic further we will be publishing a follow up paper on the embodied carbon emissions data sets, which are particularly important for real asset development funders.

Webinar: Solid strategies to conquer scope 3 in real estate

In this webinar, our senior real estate experts will explore the most material scope 3 emission sources for the sector, highlighting the opportunities and approaches that work to reduce them.

Find out more and register for the webinar

Verco can help you with carbon accounting

Verco is able to help with carbon accounting for individual investments and portfolios, including calculating emissions from investment and debt portfolios. If you are interested in discussing any of these topics further please get in touch.