Part 2 of 2: The Partnership for Carbon Accounting Financials (PCAF) embodied carbon emission datasets

PCAF has released two significant datasets for free and open access. The first is an updated European Building Emission Factor Database (EBEFD), focusing on operational carbon emission factors for mortgages and commercial real estate discussed in our previous article here. The second relates to embodied carbon emissions for real estate which this article explores.

Real estate investments can significantly impact the environment, especially in terms of embodied carbon emissions. Embodied emissions are the emissions that occur during the production, transportation, and construction of building materials. Under the GHG Protocol they are accounted for as Scope 1, 2 and Scope 3 emissions for construction companies and developers and Scope 3 emissions for funders/owners.

The structured methodology follows clear steps

PCAF provides a structured methodology to measure and report the embodied emissions associated with real estate investments. This methodology applies to financial institutions (FIs) that offer loans to building owners, project developers, and construction companies to purchase, refinance, construct, renovate, or demolish real estate.

The methodology follows the following steps:

Estimate the expected embodied emissions within the reporting year for each loan based on the type and size of the building and the materials used.

Calculate the attribution factor for each loan based on who receives the loan and how much of the property value or project cost is covered by the loan. The attribution factor represents the percentage of the total emissions the FI is responsible for.

Multiply the expected embodied emissions by the attribution factor to get each loan’s annual financed embodied emissions.

Sum up the annual financed embodied emissions for all loans to get the total financed embodied emissions for real estate investments.

The amount of embodied emissions attributed to loans depends on who receives them: building owners or construction companies. The outstanding loan amount for building owners is compared to the property value when the renovation or construction project is finished. In contrast, for construction companies and developers, the outstanding loan amount is compared to the total project costs. This means that lending to owners is more favourable regarding carbon emissions as long as the project costs are lower than the property value when the project is finished.

This methodology helps FIs to estimate their share of the emissions from their real estate-related loans and to identify opportunities to reduce their carbon footprint, in line with the saying, “You can’t improve what you don’t measure”. One way to do this is by offering green financing options to customers. For instance, FIs can offer loans with lower interest rates to customers who invest in energy-efficient upgrades or renewable energy installations. FIs can also provide information and products, such as emissions calculators and investment products, to support customers in reducing their own carbon footprint.

Embodied carbon data sources

The PCAF embodied emissions dataset combines key sources such as meta-studies, benchmarks, and credible references related to embodied emissions in buildings. However, these datasets should be considered approximations due to variability in building composition, design, life cycle stages, and assumptions made in referenced studies.

The analysis focused on several European countries representing diverse geographical locations and building practices and enabled PCAF to create two data sets:

1. Construction Materials Embodied Emissions Intensity Dataset: Includes data on various construction materials across different life cycle stages, relying on sources such as the Institution of Structural Engineers and the Inventory of Carbon and Energy (ICE). It covers the following materials: Aluminium, Blockwork, Brick, Cementitious coatings, concrete, glass, intumescent coating, plasterboard, steel, stone and timber.

2. Buildings Embodied Emissions Intensity Dataset: Comprising of data from publicly available studies and benchmarks, including sources like the Full EU-ECB database, studies by the German Sustainable Building Council (DGNB), One-click LCA, and the Green Building Council’s Net Zero Building certification system. It covers the following European countries: Austria, Belgium, Denmark, Finland, Germany, Netherlands, Sweden and the UK.

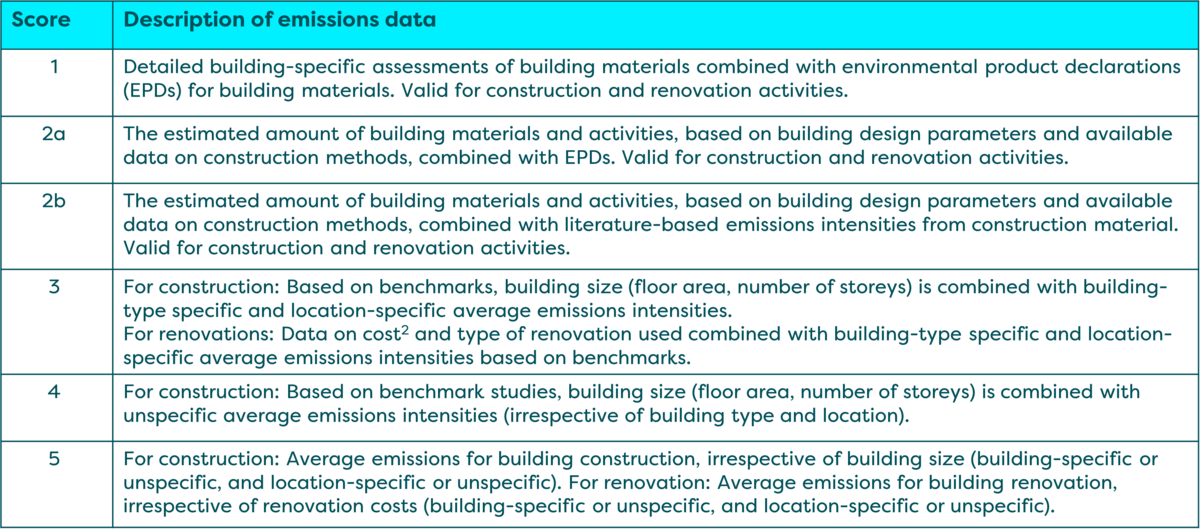

These datasets approximate embodied emissions during construction, covering diverse building types and materials. The data quality hierarchy offered by PCAF, ranging from 1 (most preferred) to 5 (least desired), guides users in estimating embodied carbon with varying degrees of accuracy. Despite the acknowledged variability and approximations due to building composition and design differences, these datasets represent a valuable resource for stakeholders seeking insights into embodied emissions, especially when actual data is unavailable.

It is important to note that while these datasets represent a valuable resource, they come with acknowledged limitations and approximations. Variability in building composition, design, and lifecycle stages and assumptions in referenced studies introduce uncertainties. Therefore, caution is advised when using these datasets, and actual data with higher quality scores (1 and 2) should be sought and used whenever possible.

These datasets from PCAF address material gaps in data related to embodied carbon emissions in real estate.

The datasets enable action by providing a structured methodology for estimating and reporting emissions associated with loans, offering valuable insights for decision-making and analysis.

FIs applying these datasets can expect several outcomes. Firstly, they gain insights into the embodied carbon footprint of different building types and construction materials. This knowledge supports decision-making processes and analysis, allowing stakeholders to focus on areas that contribute significantly to carbon emissions. Secondly, the datasets provide a starting point for estimating the range of expected embodied emissions, encouraging primary data collection and offering a basis for informed decisions towards achieving Net Zero targets in the real estate sector.

Verco is able to help with carbon accounting for individual investments and portfolios, including calculating emissions from investment and debt portfolios. If you are interested in discussing any of these topics further please get in touch with us.